The (not) obvious XRP play

It was all hidden in plain sight | The Kimchi Premium #11

It’s XRP world.

I bet most people who read this newsletter would’ve laughed off anyone suggesting XRP as a solid bet this cycle. Yes, I am projecting.

On November 14, 2014, Korea's first official Ripple coin exchange opened, and the first day's sales were completed within 2 hours, drawing attention from many people.

Ripple Market Korea Co., Ltd. launched the country's first direct Ripple coin sales service and Ripple exchange. The company aims to return transaction fee revenues proportionally to RMK (company currency) holders based on their RMK holdings, which is calculated and distributed at the end of each month to their Ripple wallets.

A Ripple Market Korea representative explained, "Ripple coin is not just limited to being a virtual currency or resource, but has the advantage of being exchangeable with actual national currencies, so we expect its currency value and popularity to continue increasing." They added, "The fact that Google Ventures, which doesn't make investment decisions easily, decided to invest in Ripple coin is a result of noting this future potential."

They also warned, "Some multilevel marketing companies and pyramid schemes are taking advantage of Ripple coin's market value," and advised caution regarding solicitations for high-value investments and sales at 10-20 times the market price.

- Chosun Biz, circa 2014

Koreans were frontrunning y’all 10 years prior. Quite impressive. But you know what’s more impressive? Buying one coin for 10 years straight.

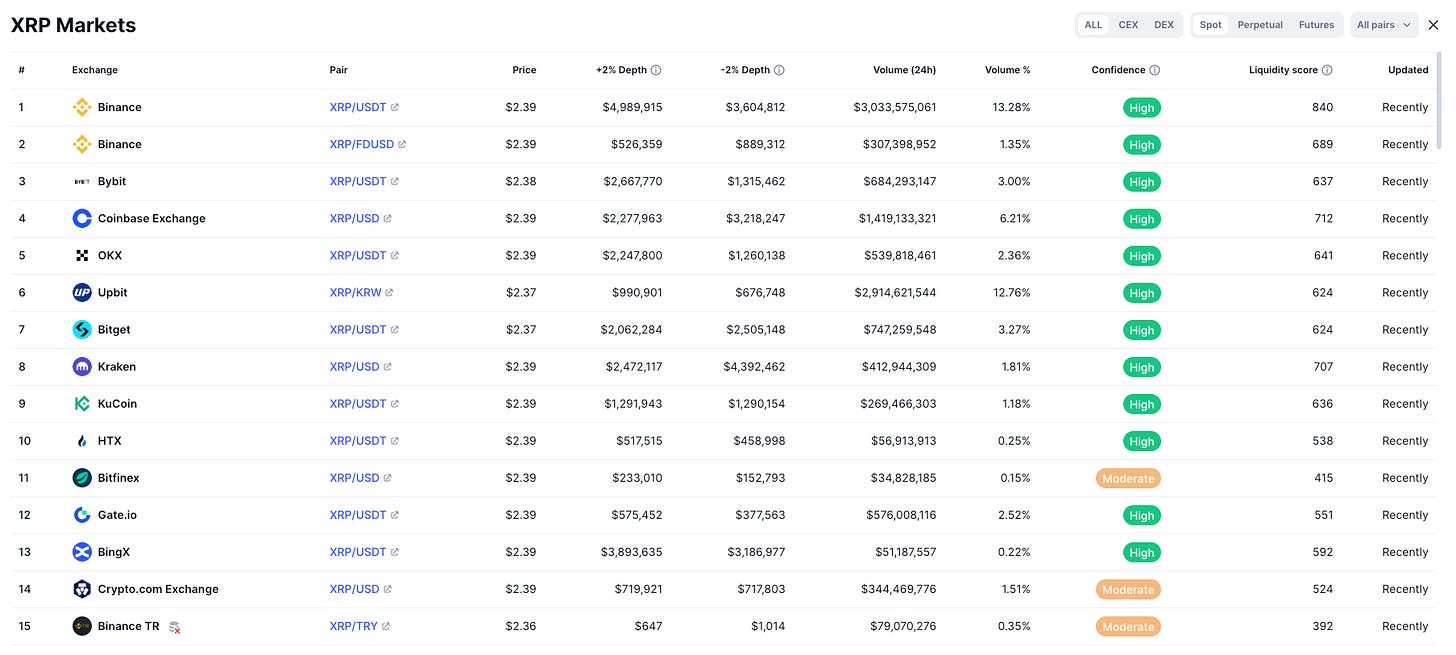

According to CoinMarketCap, 12.76% of all XRP spot volume was traded on Upbit. Although not in the screenshot, Bithumb was also responsible for 3.7% of the volume. So around 16% of XRP trading volume is coming from Korea.

Korea’s share of GDP in the world is around 1.5%. I know it’s not the exactly right comparison to make, but let’s just put that into perspective. Koreans spend a lot on their favorite coins.

I never understood the fascination over XRP. But Koreans have some reasons to believe XRP will be the next big thing.

There is this thing called ISO 20022:

ISO 20022 is a universal messaging standard for financial transactions that revolutionizes how financial data is communicated between institutions worldwide. It creates a standardized language that allows for rich, detailed information to be transmitted with each financial transaction, including comprehensive data about the sender, recipient, purpose, and context of payments.

Unlike older systems that could only handle limited data, ISO 20022 can process approximately 10 times more information per transaction, enabling better tracking, compliance, and automation of financial processes. This standard is particularly significant as major financial networks, including SWIFT, are transitioning to ISO 20022 by 2025, making it the de facto global standard for financial messaging.

The rationale is that XRP and other coins like XLM, ADA, HBAR, XDC that are compliant to the ISO 20022 standard will greatly benefit from a Trump administration.

Isn’t this too old of a narrative? Only if you’re a zoomer. Look at this photo.

The above photo was taken at the Bithumb lounge in Gangnam, Seoul. The lounge sits literally across the street where I am writing this article.

Korean boomers still live in 2017. In 2017, there was only one idea in blockchains: to create a faster decentralized network for money. That was it. Also, the type of content they consume are nothing like The Information or Pirate Wires.

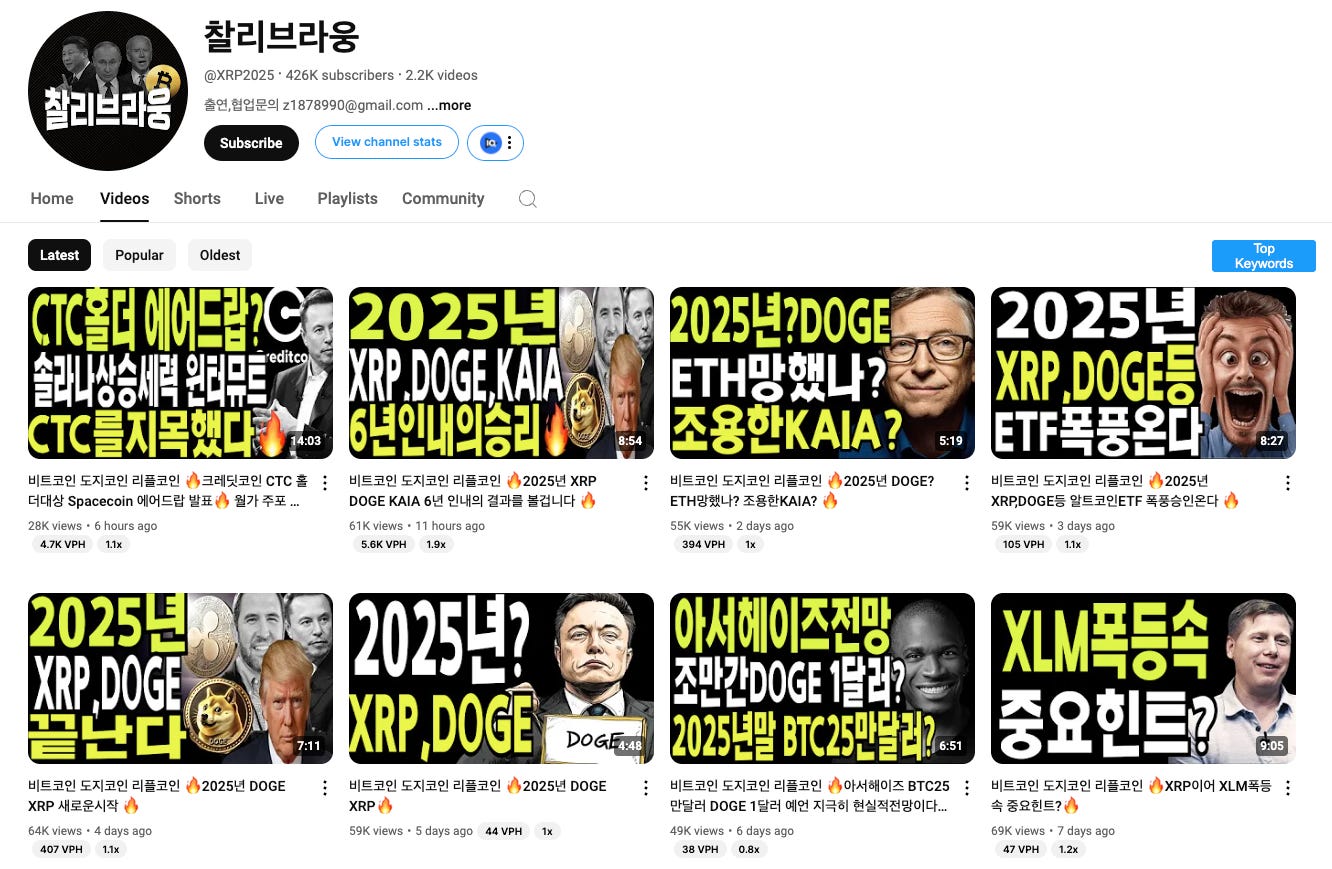

Just channels with crazy conviction and hopium maxxing. One YouTube channel stands out in this regard:

The handle is “@XRP2025”. What’s more to say? He has been pushing XRP for 6 years. That is actually insane. He doesn’t care about the trenches. He doesn’t care about DePIN. What is AI even?

Now this is the type of content that people are watching, and base their investments on. It eventually worked.

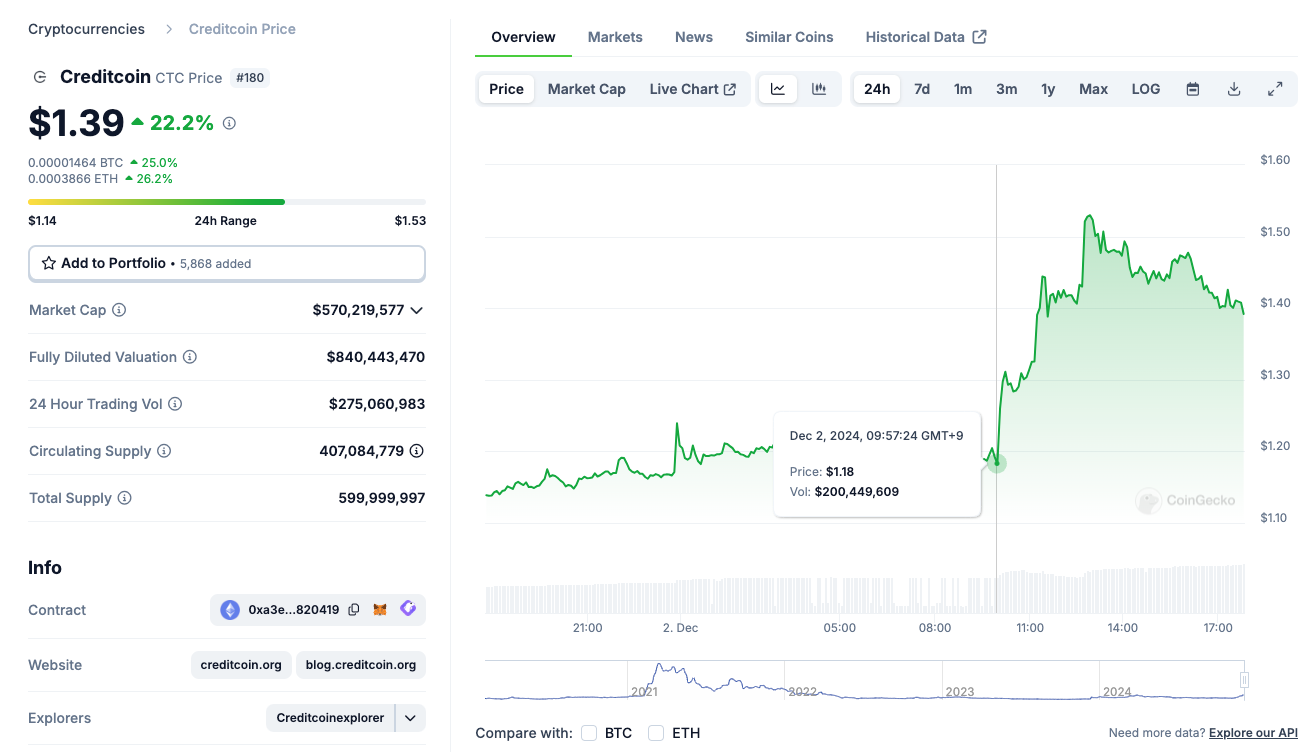

Let’s take a look at CTC, where this channel mentioned a mere 6 hours ago.

It’s up 22.2%

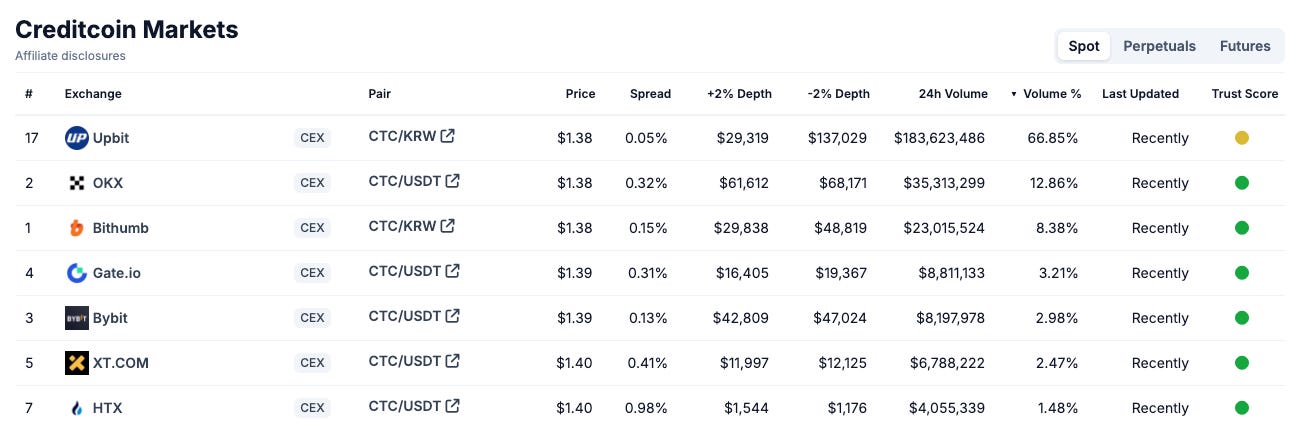

66.85% of volume coming from Upbit, 8.38% from Bithumb.

Now this is power.

Time to keep an eye on Korean ring leaders.