Despite Bitcoin representing over half of the total crypto market capitalization, it has largely existed as an idle asset. In response, staking protocols offering rewards for Bitcoin staking are emerging frequently.

However, some might ask, "How can you even stake Bitcoin?" and "Where does the yield come from?"

Through this article I will address these questions and provide my POV on Bitcoin staking in general, while using Echo Protocol on Aptos as an example.

FYI I was not paid to write this article

TL;DR

Bitcoin staking is trending as a way to improve capital efficiency of idle Bitcoins

Aptos, with its strengthening RWA connections, might serve as key infrastructure for Bitcoin staking

A $1 million BTC would be nice

About Bitcoin staking

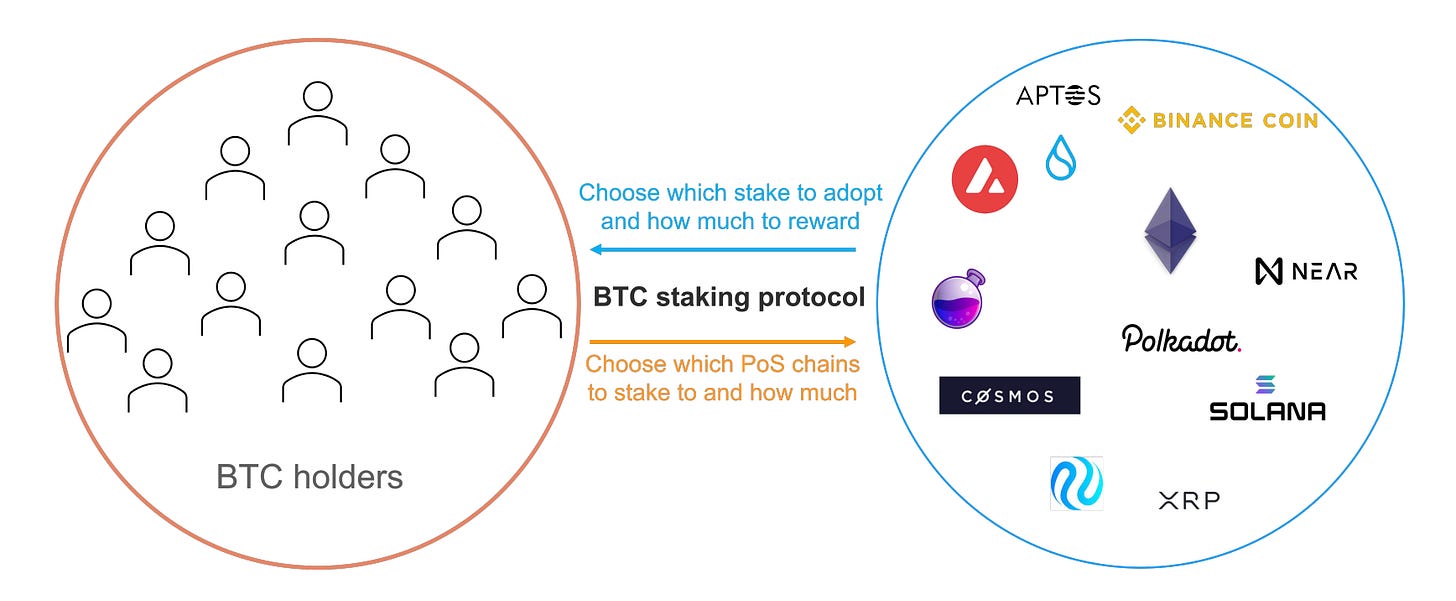

Current Bitcoin staking trends mirror the Eigenlayer-based restaking phenomenon from several months ago. This is because it can increase the capital efficiency of idle Bitcoin, while PoS networks and other services can build infrastructure based on the security provided by staked Bitcoin.

However, since Bitcoin isn't inherently a PoS system, it cannot generate interest through staking. Therefore, Bitcoin staking requires two elements:

A mechanism that makes it appear as if Bitcoin is being staked

A mechanism that simulates interest payments on staked Bitcoin

Babylon is at the forefront of this movement:

For the first time, bitcoin holders can earn yields from their idle bitcoins in a secure way: no third-party trust, no bitcoin bridging to any other chain. Bitcoin holders simply lock their bitcoins in a self-custodial way to gain the rights to validate PoS chains and earn yields as a return. Powered by the fast unbonding and scalable restaking features of the protocol, bitcoin stakers can also enjoy maximal liquidity and yields.

Babylon utilizes a “timelock” feature on the Bitcoin mainnet to create a staking-like mechanism, using these timelocked Bitcoin as collateral to secure PoS chains and earn “interest”. This interest is paid out in the native tokens of the chains where Bitcoin is “staked”.

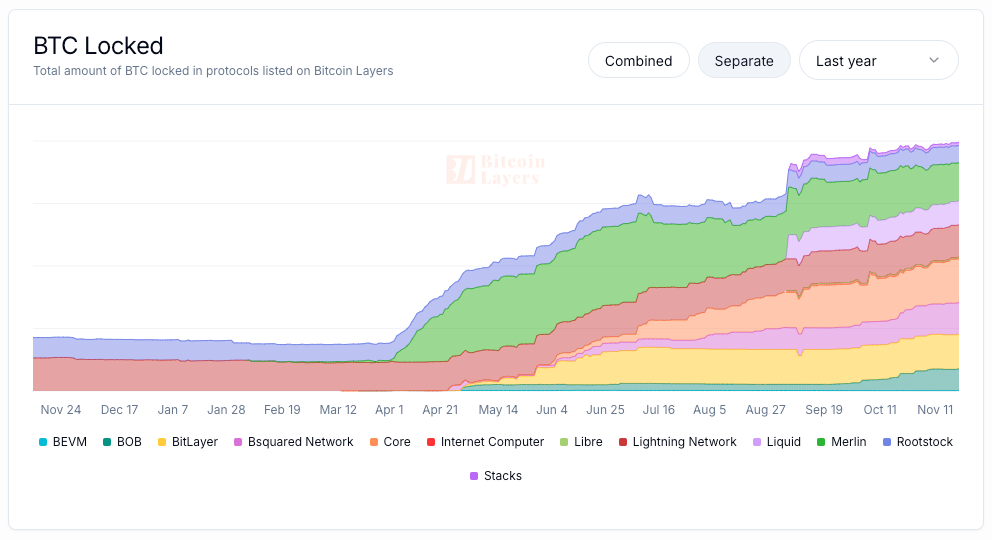

Bitcoin staking has gained tremendous popularity since Babylon's launch. Currently, over 23,000 BTC has been staked through Babylon, and approximately 40,000 BTC has been bridged to various Bitcoin L2s. (Note: The graph below may not perfectly track all bridged BTC, so there may be some discrepancies.)

However, those familiar with the current state of “Bitcoin L2s” cannot ignore the associated security risks. Most L2s currently carry high risks in areas such as bridging, data availability, and network decentralization, and it's worth noting that Babylon itself is not entirely risk-free.

Even though self-custody is possible on the mainnet through Babylon, when using BTC-backed synthetic assets on destination chains, it inevitably creates dependence on new contracts and introduces potential vulnerabilities. Recently, a vulnerability was discovered in Bedrock's uniBTC smart contract, resulting in the theft of funds from the liquidity pool.

On Sep-26-2024 06:28:23 PM UTC, a vulnerability in the uniBTC smart contract was exploited, allowing the exploiter to mint 30.8 uniBTC and swap them for wBTC in Uniswap pools. In response, we paused the vulnerable contract and implemented a fix to mitigate the vulnerability, which was later confirmed to have affected approximately $2 million in liquidity, primarily within the Uniswap pool.

From the perspective of whales holding 100,000 Bitcoin or mining companies that mine hundreds of Bitcoin daily, such incidents are unacceptable. While in Bedrock's case, the underlying BTC collateral remained intact and there wasn't a major issue, if someone were to manipulate the reported number of collateralized BTC or engage in misconduct, it could lead to irreversible consequences.

Ultimately, since there are unknown risks associated with activities outside the Bitcoin mainnet, regardless of how high the yields might be, Bitcoin holders may hesitate to commit large amounts of Bitcoin. This represents both the biggest risk and challenge that Bitcoin staking needs to address.

Why staking persists despite risks

The number of Bitcoin holders maintaining positions for over 5 years has consistently increased regardless of price fluctuations, now exceeding 30% of all Bitcoin wallets. However, this figure might be inflated when considering lost coins. Chainalysis estimates that between 2.7 and 3.8 million Bitcoin are permanently lost. Even excluding this amount, over 1.1 million Bitcoin have remained stationary for five years. Extending the timeframe to one-year holders, this percentage reaches 65%.

Approximately half of all Bitcoin remains inactive. The challenge is that profiting from Bitcoin inherently requires selling it, which conflicts with long-term holding strategies. Unlike Ethereum, Bitcoin cannot generate staking rewards, limiting returns to price appreciation only. This creates a strong incentive for moving Bitcoin to other networks as collateral for generating steady returns.

Echo Protocol and Aptos's path forward

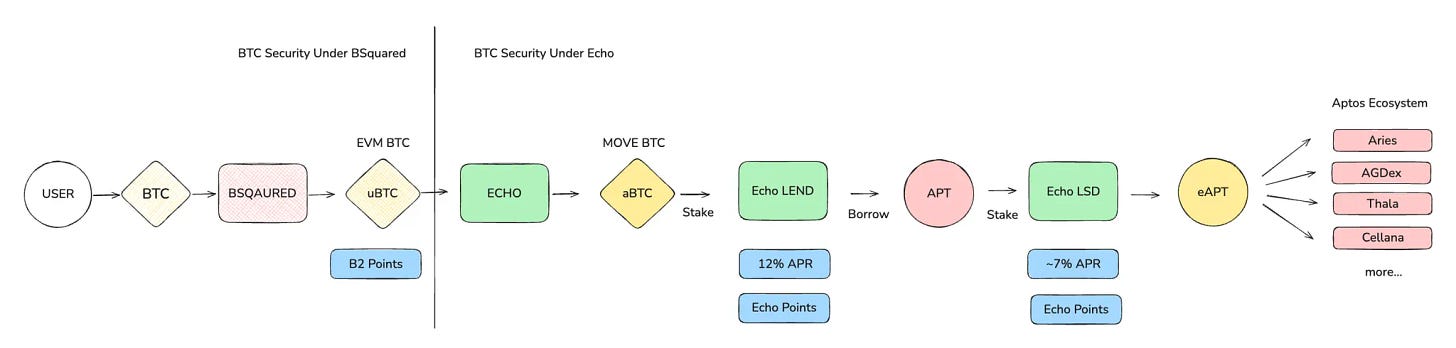

Echo Protocol currently connects to the Bitcoin ecosystem through a bridge linking B² Network and Aptos. Users must first bridge their Bitcoin to B² Network, then bridge again to Aptos to reach Echo Protocol.

Despite these additional steps, users are drawn to Echo Protocol for two main reasons:

Exposure to the relatively unexplored Move ecosystem

Limited availability of Bitcoin staking options

While some might question whether Echo Protocol is creating excess supply in an already saturated Bitcoin staking market, the amount of BTC on Bitcoin L2s and Babylon only accounts for 0.2% of total Bitcoin circulation.

And Echo Protocol has demonstrated significant demand, filling its 2,166 BTC pool within 10 days. Additionally, B² Network, which supplies Bitcoin directly to Echo Protocol, has exceeded 5,000 BTC in TVL, showing remarkable growth.

Bitcoin staking actually has large demand.

But most Bitcoin staking programs currently operate through point systems or native token rewards, which may not be sustainable for long-term interest payments on an asset with a market cap exceeding $1.5 trillion.

Imagine procuring yield for a $1.5 trillion asset only by selling native tokens that are hundreds of times smaller in size. That seems impossible in my view. At least we need something that is similar to size, without creating excessive sell pressure on tokens for everyone to win.

So my theory is, Real-world assets (RWA) like bonds or real estate could provide a more practical solution for Bitcoin staking yields. Just in time, Trump and many crypto-friendly figures were elected. Now a full-scale institutionalization of crypto has just started.

Coincidentally, Aptos is actively advancing RWA integration:

BlackRock BUIDL Fund Launch on Aptos

First non-EVM blockchain to integrate BlackRock funds

BUIDL fund reached $500M AUM within 4 months on Ethereum

Franklin Templeton Partnership

Integrated FOBXX fund (October 2024)

Second-largest tokenized fund with $435M market cap

Attracted over $20M investment through Aptos

Ondo Finance Collaboration

Strategic partnership for real asset tokenization

Integration of USDY U.S. Treasury product

AMM pool availability and collateral acceptance through Thala

Challenges and surreal solutions

The integration of Bitcoin staking with RWA could lead to reduced activity on the mainnet. Bitcoin that simply remains static without any activity could eventually result in a decreased security budget, which poses a significant long-term threat to the Bitcoin network. However, if Bitcoin prices continue to rise, the security budget could be somewhat managed even without significant mainnet activity.

As of writing, Bitcoin is hovering around $90,000. Following Trump's election, positive sentiment regarding Bitcoin's role as a strategic asset has strengthened. This is largely due to the Republican control of Congress and expectations that crypto-savvy figures like Vivek Ramaswamy and Elon Musk will wield significant influence in the Trump administration. If the United States truly accepts Bitcoin as a strategic asset and governments and sovereign wealth funds worldwide begin accumulating Bitcoin, its price potential becomes limitless.

While these predictions might seem far-fetched, given the rapid institutionalization of crypto led by the millennial cabinet, viewing Bitcoin's future through an optimistic lens might be the more appropriate perspective.